Our Readers' and Editors' Favorite Cash-Back Credit Cards

Two cards rung up a lot more votes than the pack in this week’s Cash-Back Credit Card Co-Op, but we have our own suggestion as well.

Two cards rung up a lot more votes than the pack in this week’s Cash-Back Credit Card Co-Op, but we have our own suggestion as well.

Suggested Reading

Related Content

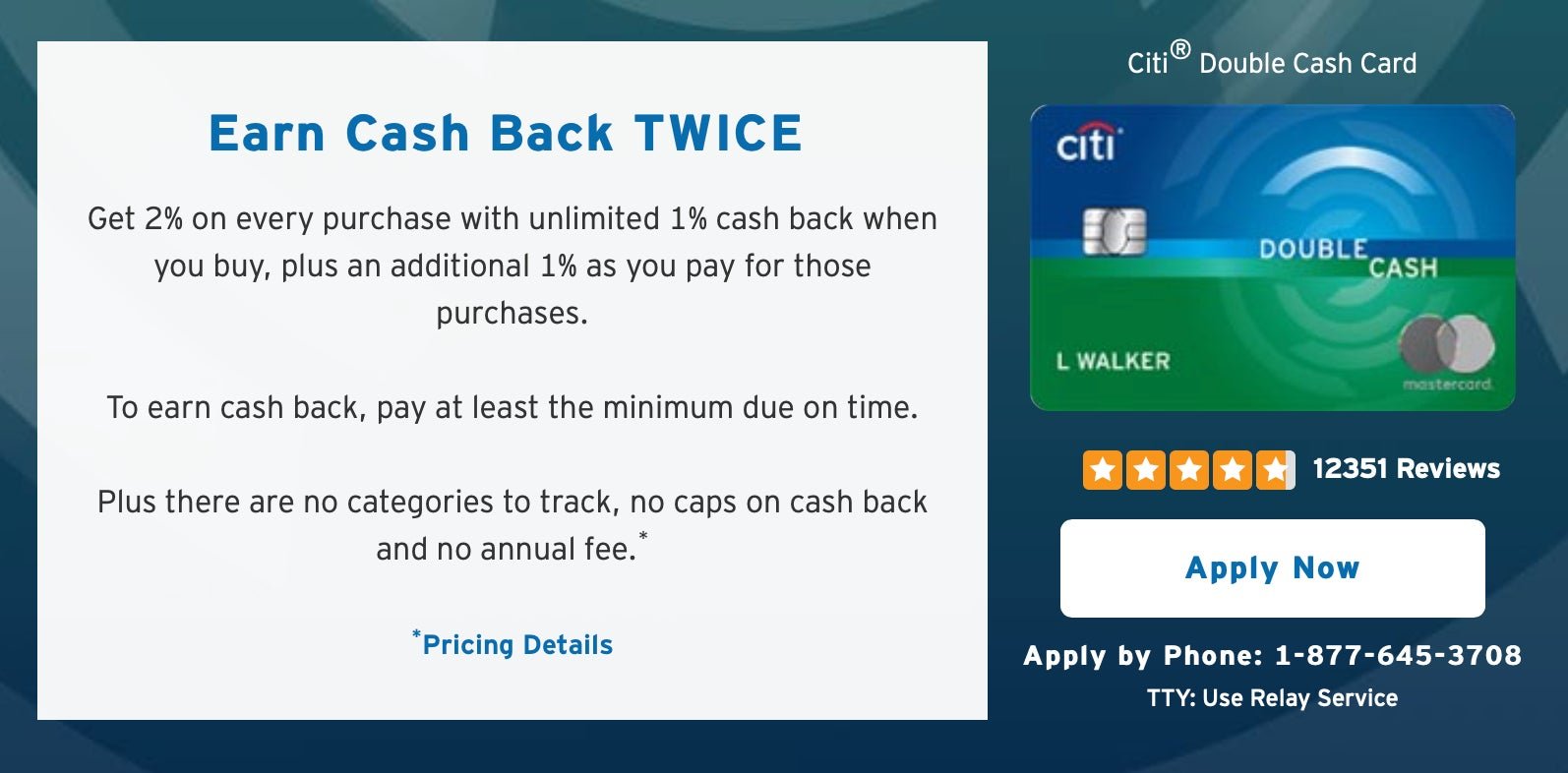

- No annual fee

- 2% cash back on all purchases (1% when you buy, 1% when you pay your credit card bill)

Citi Double Cash is the best general purpose cash back card for me. I pay off the bill every month and get 2% cash back. On everything. No annual fee. - discokryptonite

Citi Double Cash. It’s a no annual fee, 2% cashback card, which I love for its simplicity. - elRobRex

Amazon Prime Rewards Visa

The Basics:

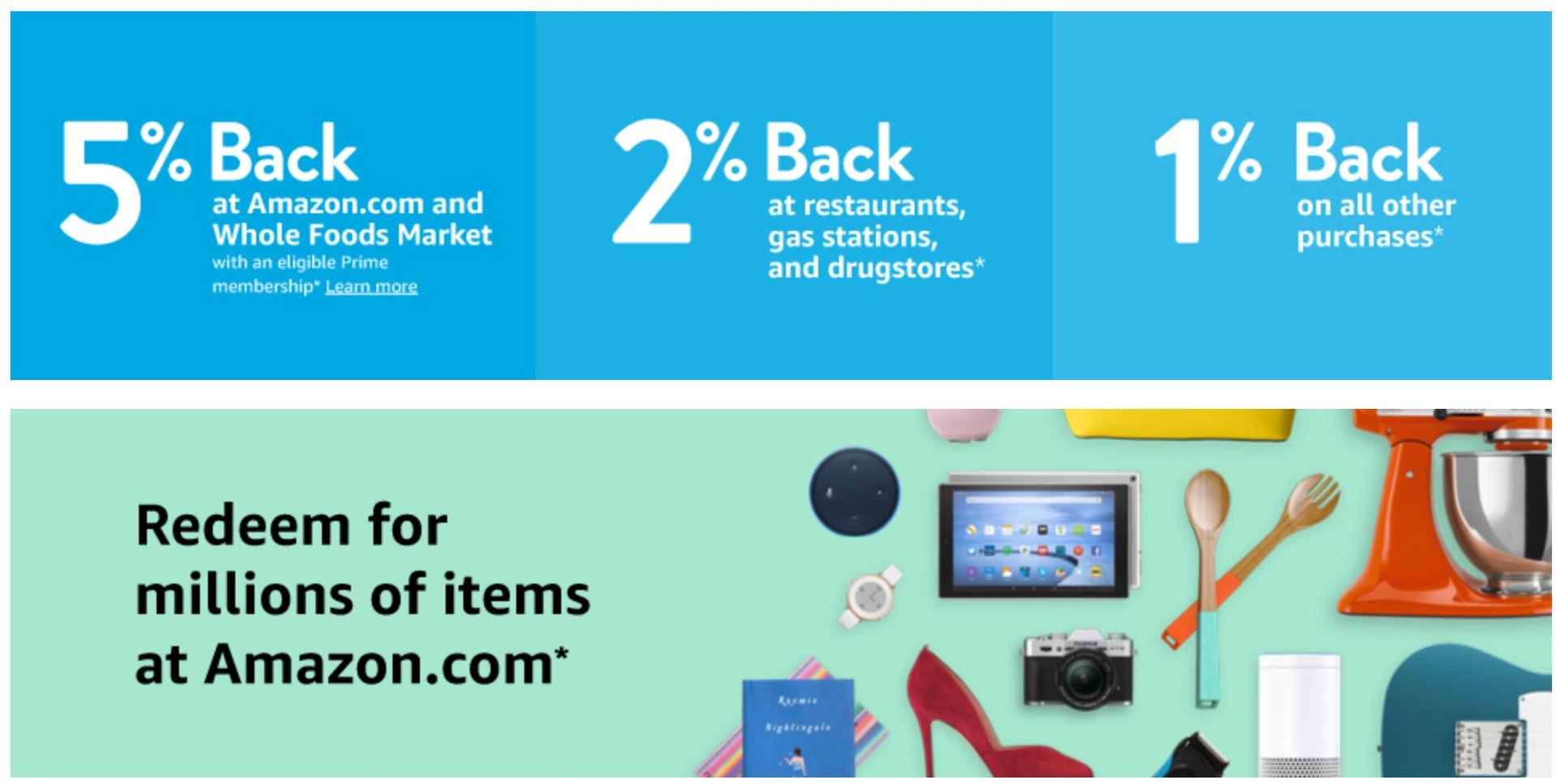

- No annual fee, but only available to Amazon Prime members

- 5% cash back on Amazon and Whole Foods purchases

- 2% cash back at restaurants, gas stations, and drugstores

I buy a ton on Amazon, so 5% back is great there. You also get 5% back at Whole Foods, for those shoppers out there. Then you get 2% back at Gas Stations and Restaurants, then 1% back at everything else. Pretty much my go to card since getting it. - yanksno1

Same. I keep my points all year and used them for Christmas shopping. Takes so much stress off at the holidays! - jenziebenzie

This is my Favorite card. I use it for everything I can. We use Amazon a lot in our household so it really pays off. Almost covered the tax in most cases and if you happen to be buying something big it really works out well. I just recently upgraded my speaker system and the $1500 I spent was a nice $75 credit.

Also, I highly recommend you just apply the monthly credit to your bill. Its a nice compounded savings that might not be massive but certainly adds up over time. - sholcomb

Chase Freedom Unlimited

The Basics:

- No annual fee

- 3% cash back on all purchases for your first year (first $20,000 in purchases), then 1.5% thereafter

- Chase Sapphire Reserve and Chase Sapphire Preferred cardholders can convert cash back into Ultimate Rewards points for travel redemptions

On paper, the Freedom Unlimited isn’t as compelling as the Citi Double Cash, since it earns 1.5% back (after the aforementioned 3% introductory period), rather than 2%. But when you pair it with a Chase Sapphire travel rewards card, you can convert your cash back into Ultimate Rewards points at a 1:1 ratio. Since Ultimate Rewards Points are worth about $.02 each (according to The Points Guy’s latest valuations), that effectively doubles the value of your cash back.

For more information on how the Ultimate Rewards ecosystem works, check out our guide.