Southwest's New Business Card Has a Huge Welcome Offer For Companion Pass Chasers

The Southwest Rapid Rewards Priority Credit Card has been one of our favorite airline-branded credit cards since it launched last year, and now, you can get a similarly rewarding card for your business or side hustle: the Southwest Rapid Rewards Performance Business Credit Card.

The Southwest Rapid Rewards Priority Credit Card has been one of our favorite airline-branded credit cards since it launched last year, and now, you can get a similarly rewarding card for your business or side hustle: the Southwest Rapid Rewards Performance Business Credit Card.

Suggested Reading

The Southwest Performance Business Card earns Southwest Rapid Rewards points, which can be used to book any available seat on any Southwest flight, with no blackout dates. Redemption rates vary a bit, but you can generally expect your points to be worth about 1.5 cents each.

Related Content

Plus, since Southwest doesn’t charge any change fees, you can change your flight (or even rebook the same flight at a lower price) at any time, and only pay (or receive back) the difference in points. I’ve personally gotten thousands of Rapid Rewards points refunded to my account over the years by periodically checking to see if a flight I booked got cheaper.

With the Performance Business card, you’ll earn three points per dollar spent on Southwest purchases, including flights, and also hotel and rental car bookings made through Southwest.com. Befitting the card’s business focus, you’ll also earn two points per dollar on social media and search advertising, as well as internet, cable, and phone bills. And of course, you’ll earn one point per dollar on all other purchases.

You’ll also earn 1,500 tier qualifying points for every $10,000 in purchases, up to a maximum of 15,000 points per year. Separate from the standard Rapid Rewards points you’ll earn on all purchases, these points count towards your Southwest A-List status, which kicks in at 35,000 points or 25 flights per year.

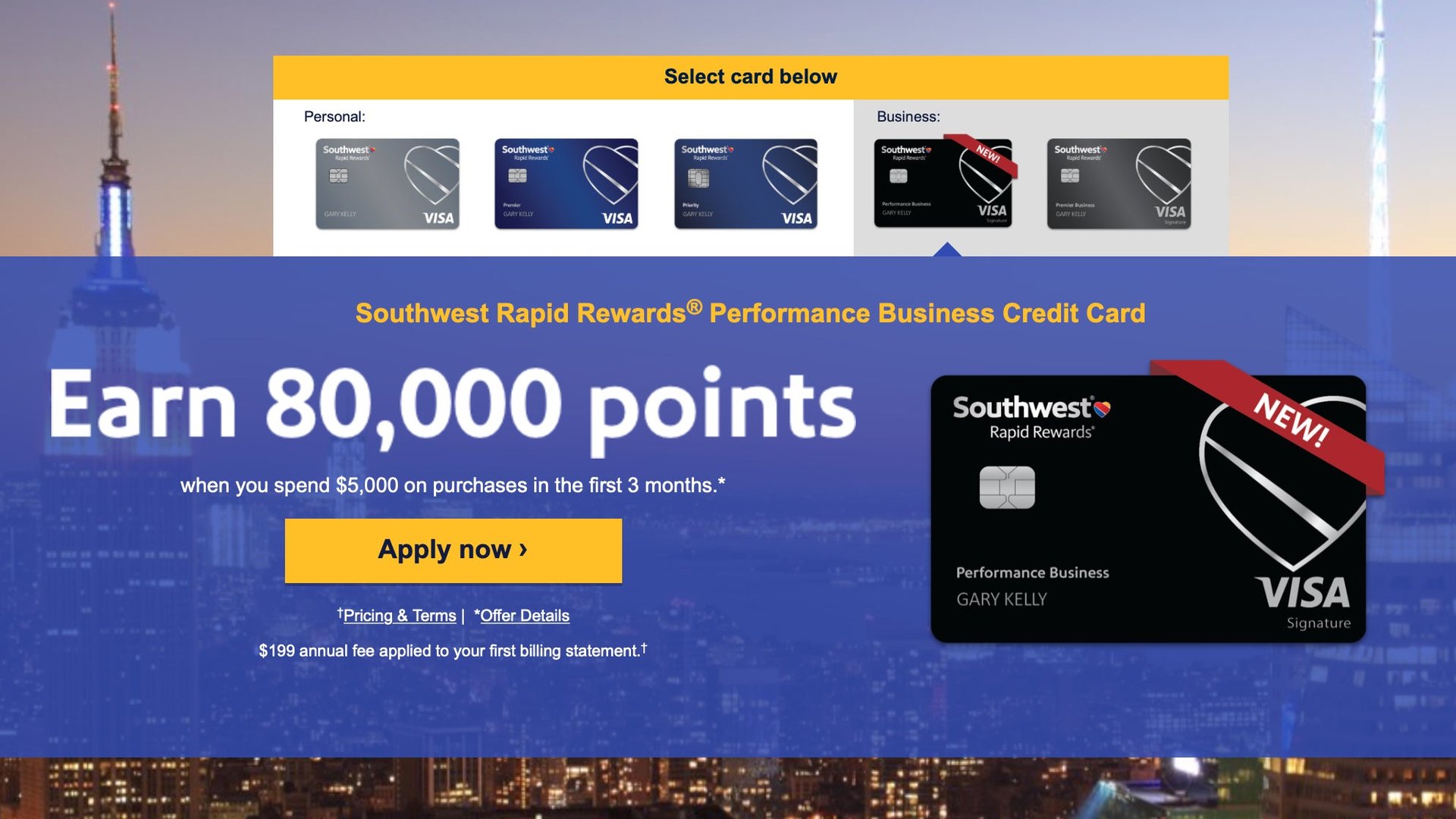

The Performance Business Card has the highest minimum spending requirement of any Southwest card, but also the most rewarding welcome offer: 80,000 points after spending $5,000 in your first three months, worth roughly $1,200 in Southwest travel (according to The Points Guy’s 1.5 cent valuation).

Those 80,000 points (plus any others you earn from spending on the card) will count towards your Companion Pass qualifying for the year. So if you’ve already earned 30,000 qualifying points this year, even if it was from a welcome bonus on a personal Southwest card, this welcome offer alone will put you over the top.

The card does carry a $199 annual fee however, the highest in Southwest’s credit card lineup.

You’d expect business-friendly perks for a high-end card such as this, and Southwest delivered big time. You’ll get the same four annual upgraded A1-15 boarding positions as the Rapid Rewards Priority card (subject to availability), but also an up to $100 credit every four years for TSA Precheck or Global Entry (a first for a Southwest card), and 365 all-day Wi-Fi credits per year. Just pay for Wi-Fi with the card, and your account will be credited for the $8 cost.

But unlike the $149/year Rapid Rewards Priority card, there’s no $75 annual travel credit, and no 20% cash back on in-flight purchases, both of which are disappointing omissions.

That said, you will get 9,000 Rapid Rewards points (worth roughly $135) on your cardmember anniversary every year, you won’t pay foreign transaction fees, and you can get extra cards for your employees at no cost (all of whom can share the 365 Wi-Fi credits).

If you run your own business (even if it’s just occasional freelance work or gig economy jobs), want to keep your expenses separate, and could make good use of those 80,000 Rapid Rewards points (like, say, if it would get you Companion Pass), we wholeheartedly recommend this card. In addition to one of the most valuable welcome offers we’ve ever seen on any card, its added perks like Wi-Fi credits, upgraded boarding (subject to availability), and the Global Entry/TSA Precheck credit will make any Southwest flight more enjoyable.

G/O Media Commerce has partnered with The Points Guy Affiliate Network for our coverage of credit products. G/O Media Group and The Points Guy may receive a commission from card issuers.